Assessing Your Companies

How to get support to companies faster with Abaca’s Venture Investment Levels

This article covers how to use Abaca to assess companies you work with and get them connected to the right sources of capital and support as they level up.

The process of matching companies with investment can be frustrating and overwhelming for everyone involved. Abaca makes raising capital and providing support easier and more efficient by level-setting where each company is on its pathway to scale.

What is a Venture Investment Level (VIL)?

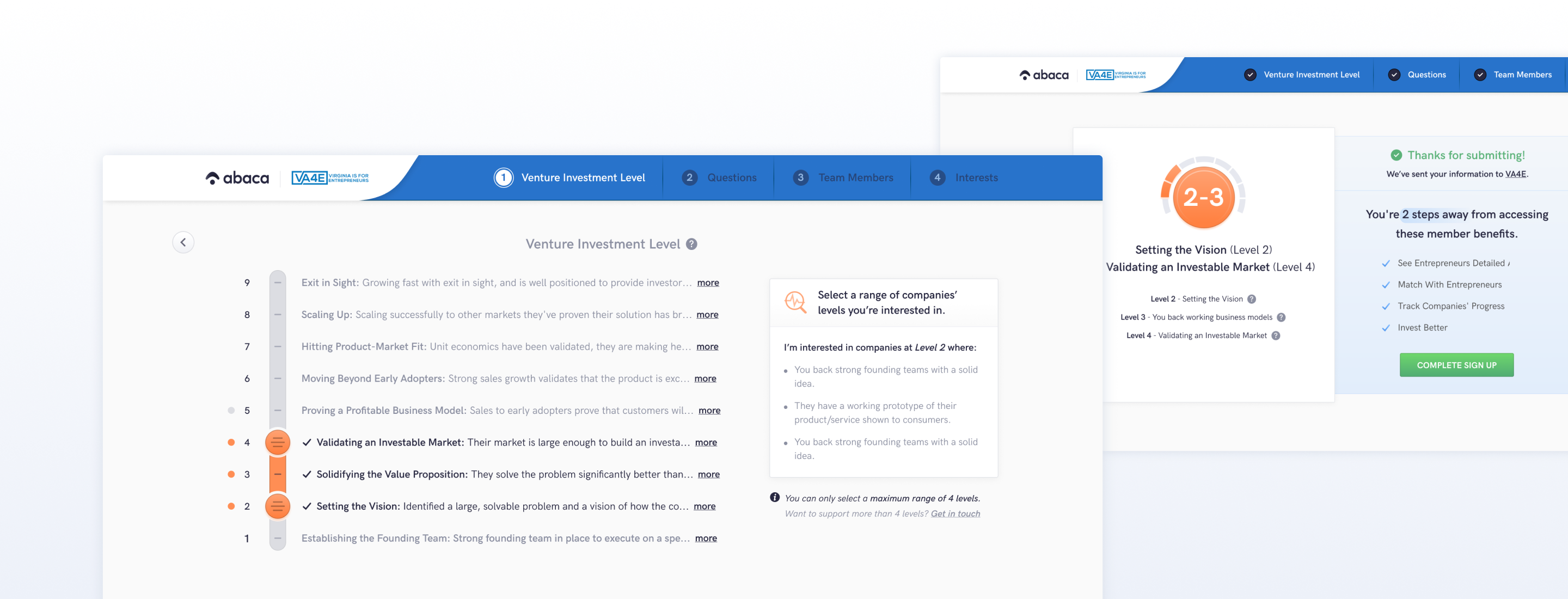

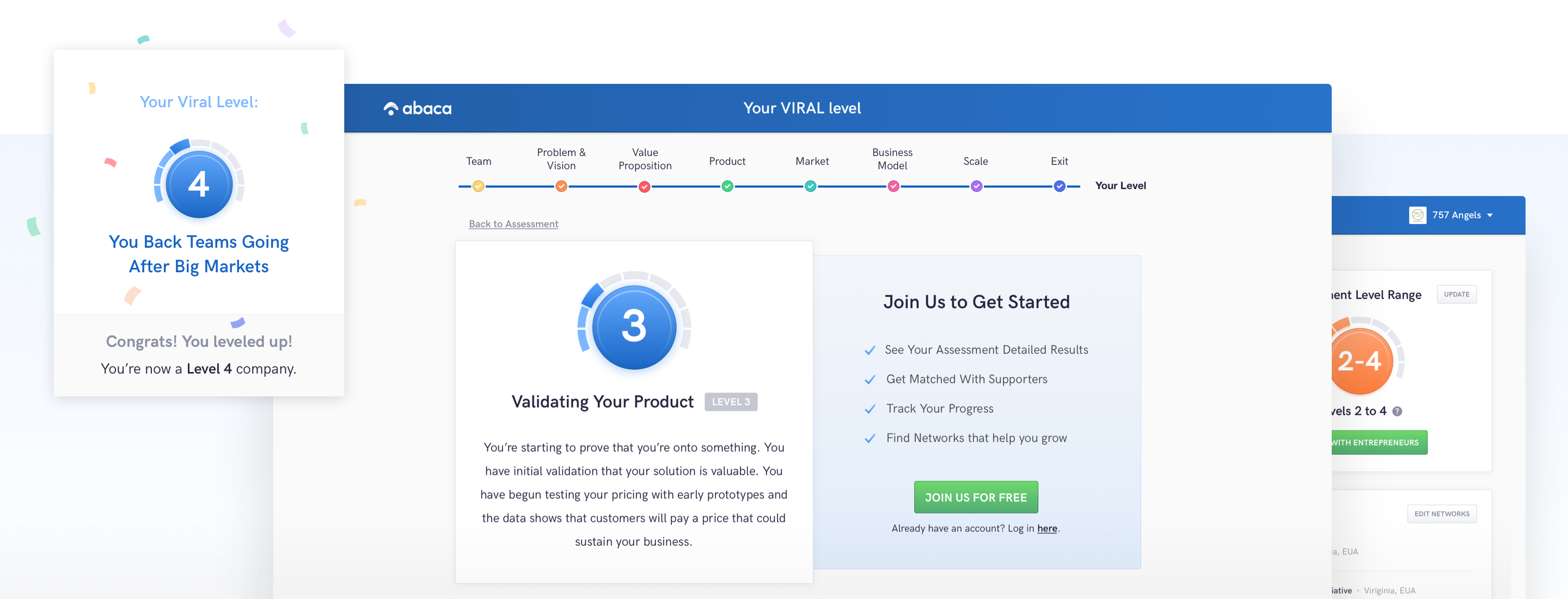

Abaca’s investment readiness assessment generates a Venture Investment Level (VIL). Every company has a VIL, from Level 1 — a company with a founding team and a vision — to Level 9, a large, market-leading company ready for an exit. And each supporter and investor has a level or range of levels of companies they support, providing an important piece of matching criteria.

The VIL assessment on Abaca includes an overall investment readiness level, a level for each of 8 business categories, milestones that act as a roadmap for leveling up, and pointers to the types of capital appropriate for each level.

The VIL provides a common language between entrepreneurs and investors. For more, here is how the milestone-based assessment works.

How to use VIL in your process

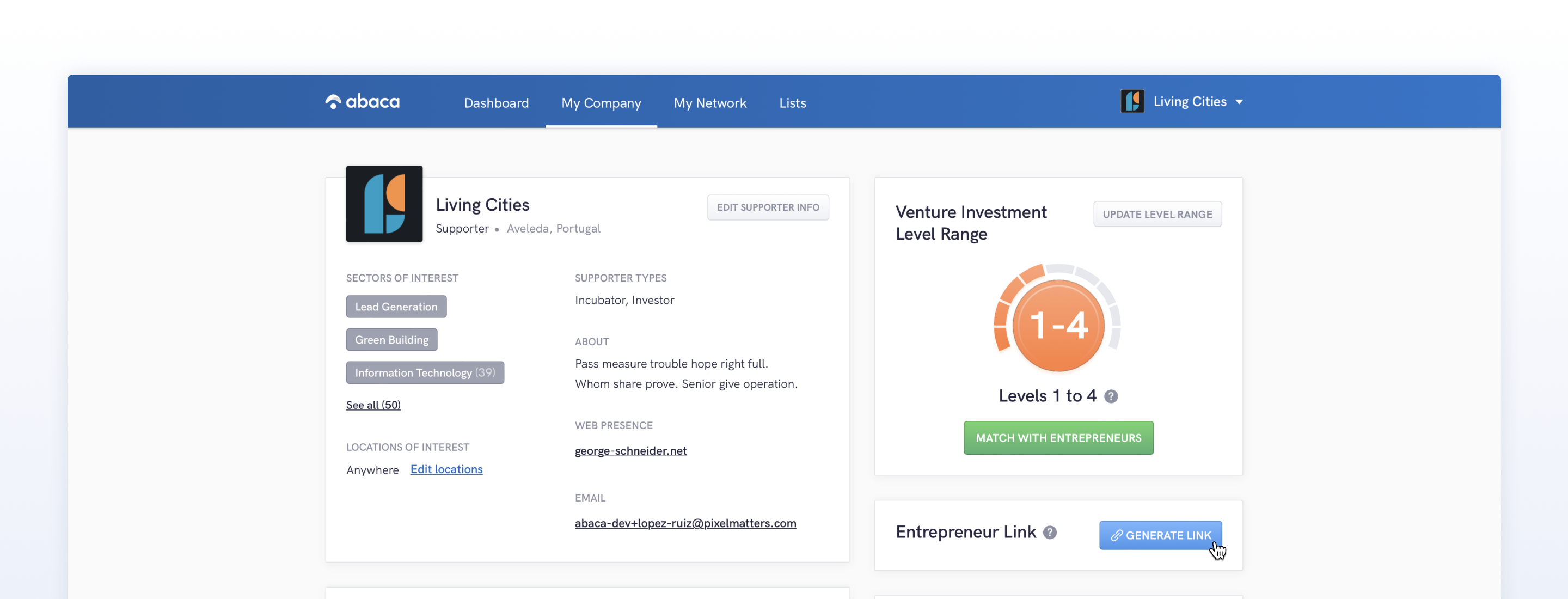

Abaca generates a direct link to the assessment for your account, which you can post on your website, send in replies to those who contact you, or add to your current intake or application process.

Full applications

Village Capital, Abaca’s creator, uses Abaca for all of its accelerator program applications. If you need a more rigorous application process in addition to VIL and basic company profile data (location, sectors, etc.), please contact us. In addition to the assessment, Abaca offers flexible bundles of application questions with standardized answer formats, so you can get started quickly and easily integrate application data with other systems, from a spreadsheet to CRMs and pipeline management systems.

How one investor uses the assessment

An investor we worked with in the U.S. uses Abaca whenever he receives a cold contact from an entrepreneur. He simply replies to their message asking them to go to the link. By looking at their level and milestones, he could quickly assess whether to set up a call or to send a note explaining why the company wasn’t a good fit. He loves that he can provide specific feedback, particularly when he would become interested, once the company advanced further.

Why send companies to Abaca for an assessment?

Earlier, we mentioned how Abaca can make finding capital and support less painful. Ways it can help include:

- Establishing a common language around stage of maturity, sector, geography and other criteria important to you.

- Improving the productivity of initial meetings or interviews. Jump right to what’s important about the business.

- Providing an ongoing roadmap for support and mentoring.

- Generating consistent data about companies, which can then be used to generate a match score with your particular criteria.

- And, if a company isn’t a good fit yet, giving you concrete reasons for saying no, which makes the process more founder friendly.